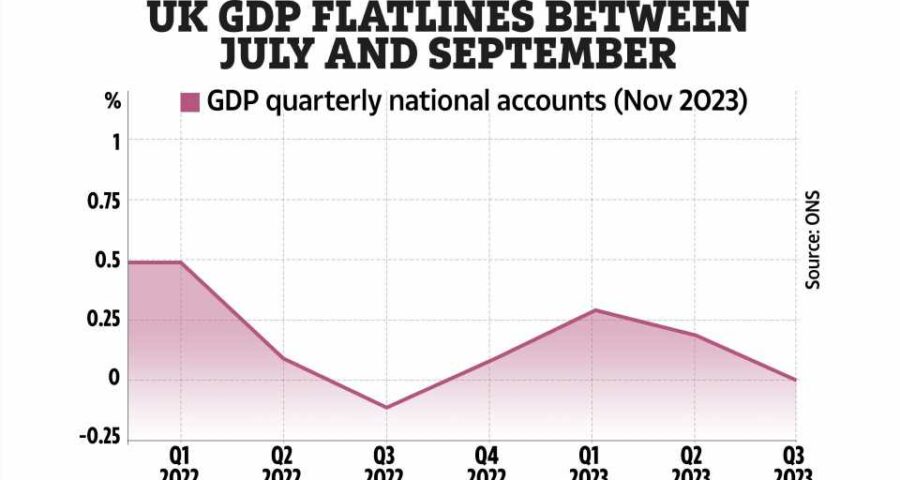

THE UK economy could be heading for recession after new statistics revealed it flatlined between July and September.

Data from the Office for National Statistics (ONS) reveals Gross Domestic Product (GDP) showed no growth across the three months.

A healthy economy is one where GDP is growing but if it stalls or is falling, it's bad news for businesses and consumers.

If GDP drops for two consecutive quarters it is defined as a recession, which leads to job losses and wages stalling.

The UK last went into recession in 2020 after the coronavirus pandemic hit, shutting down large parts of the economy.

The latest figures from the ONS come after GDP increased by 0.2% between April and May.

Read more in Money

I tested supermarket steak pies – the best is just £2.99 and is good as any pub's

'Retail is dying' as supermarket with 300 locations to close store permanently

Experts said the latest figures could be partly blamed on wet weather and industrial action in the summer.

Flatlining GDP could also be down to soaring borrowing costs and stubbornly high inflation, which sat at 6.7% in September, they said.

GDP increased by 0.2% in September following growth of 0.1% in August.

However, across the three months it remained flat, with a 0.1% fall in the services sector offset by a 0.1% increase in the construction sector.

Most read in Money

Fan favourite Christmas chocolate set to go missing from shelves

Tesco shoppers ‘absolutely gutted’ as supermarket axes savings scheme

Fans divided over new John Lewis ad – as some moan that ‘Christmas is ruined’

Nestle discontinues another iconic chocolate bar after 60 years

Across the same time frame there was flat output in the production sector.

Darren Morgan, director of economic statistics at the ONS, said: "The economy is estimated to have shown no growth in the third quarter.

"Services dropped a little with falls in health, management consultancy and commercial property rentals.

"These were partially offset by growth in engineering, car sales and machinery leasing.

"There were also small growths in manufacturing, led by cars and metal products, while construction grew due to new commercial property work.

"In the month of September the economy grew slightly, with increases in film production, health and education.

"This growth was partially offset by falls in retail and computer programming."

Alice Haines, personal finance analyst at Bestinvest, said the "dismal" latest quarterly figures could reignite fears the UK economy is heading for recession.

This would have "devastating consequences for people’s finances", she added.

It comes after the Bank of England (BoE) also warned of a recession risk in the run-up to the expected general election next year.

Meanwhile, the British Retail Consortium and Barclays this week said retail sales were down in October, signalling households are cutting spending ahead of Christmas.

The UK could already be in recession, according to analysis by Bloomberg Economics, as interest rates soar and households rein in spending.

The official figures from the ONS on economic growth are backwards looking, which means they are for previous months rather than real-time.

The BoE recently signalled it intends to keep its base rate, a measure used to control inflation, high for an extended period.

It most recently held the rate at 5.25% after consecutive rises, but inflation still remains stubbornly high, meaning the cost of everyday essentials is rising.

Emma-Lou Montgomery, associate director for personal investing at fidelity international, predicted it might not be until next August when the base rate would start to come down.

She added: "That means we’re still in uncertain territory for some time yet and that won’t be good news for retailers who badly needed the forthcoming festive spending season to be one that boosted the coffers."

What does it mean for your finances?

Today's figures mean the economy isn't growing or shrinking, but after near zero growth in the previous quarter, it could mean recession is coming.

In a recession job losses are common, as companies try to cut their costs to stay afloat.

Businesses may also go into administration or go bust.

The 2008 recession, for example, saw the loss of high street stores including music retailer Zavvi, clothes shop Principles, and stalwart Woolworths.

The Government may make cut backs or raise taxes to try and shore up its finances – alternatively, it may decide to increase budgets to spend its way out of the problem.

And the number of people in debt and arrears is also likely to soar, and there could be more defaults on loans and mortgages or repossessions and bankruptcies.

Alice Haines said: "A recession can have devastating consequences for people’s finances as a weaker economy can cause earnings to stagnate or drop and redundancies to rise as companies batten down the hatches and focus on reducing costs.

"Such a scenario, set against a backdrop of worryingly high borrowing and living costs, which eat into disposable incomes and leave little spare for life’s little luxuries, spells disaster for household finances already under severe strain."

How to protect your finances

There are ways you can keep your cash safe if you're worried about the UK's economic outlook.

Make sure you go through all your bank statements and accounts so you know what your income and outgoings are every month.

Of course, there are bills that you can't avoid paying – but that doesn't mean you can't cut back in other ways.

For example, you can save money by moving to a cheaper mobile phone tariff or by axing subscriptions you don't need like Netflix or Amazon Prime.

If you've got any outstanding debts, the worst thing to do is ignore them as it will only make your financial situation worse.

Stay on top of what you owe and always repay priority debts.

There are also plenty of organisations where you can seek debt advice for free.

These include:

- National Debtline – 0808 808 4000

- Step Change – 0800 138 1111

- Citizens Advice – 0808 800 9060

You should also check what benefits you are eligible for as you might be able to claim without realising.

Entitledto's free calculator works out whether you qualify for various benefits, tax credits and Universal Credit.

If you don't want to register, consumer group moneysavingexpert.com and charity StepChange both have benefits tools powered by Entitledto's data that let you save your results without logging in.

There is also emergency funding available for struggling households, which is dished out by local councils.

The Household Support Fund is designed to help those on a low income or benefits cover the cost of food, energy and general living costs.

What help is available varies depending on where you live as each council sets it own eligibility criteria.

Read More on The Sun

I'm A Celeb official line-up as Nigel Farage and Britney's sis head into jungle

Major DIY homeware chain to shut store doors permanently before Christmas

It's worth getting in touch with your local authority to see what you might be able to get.

You can find what council area you fall under by using the government's council locator tool online.

You can also join our new Sun Money Facebook group to share stories and tips and engage with the consumer team and other group members.

Source: Read Full Article